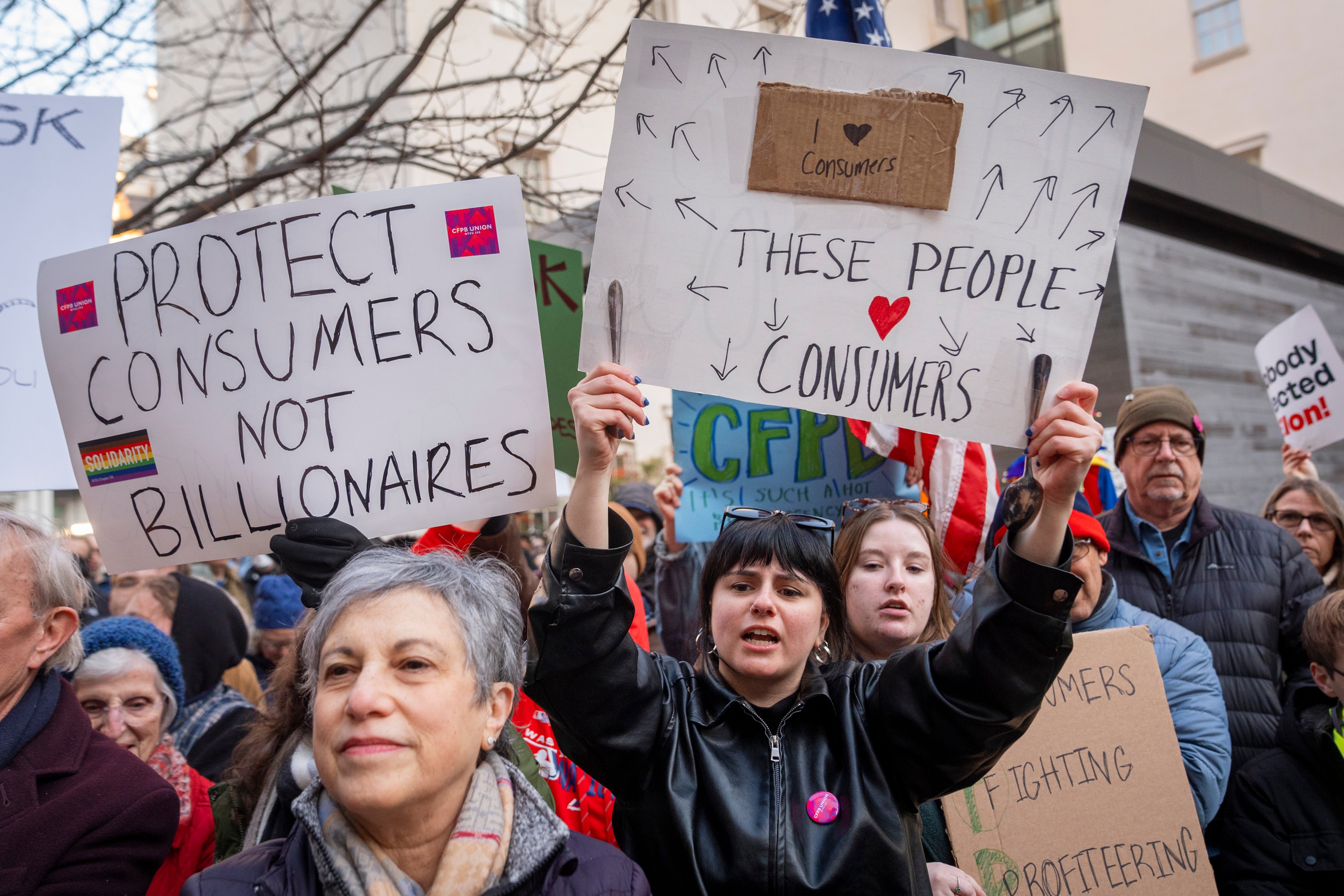

States look to bolster consumer protection as Trump promises tariffs and trade war

Officials warn that the closing of the Consumer Financial Protection Bureau will have dire effects on vulnerable consumers including veterans and the elderly

State legislators are looking at ways to bolster protections for their consumers after Donald Trump’s vow to close down the federal watchdog and impose exorbitant tariffs on foreign trade partners.

Officials in states including Massachusetts and Illinois are among those warning that the shuttering of the Consumer Financial Protection Bureau will have dire effects on vulnerable consumers including veterans and the elderly.

Founded in 2010 by Senator Elizabeth Warren, the CFPB was established to monitor credit card companies, mortgage providers, debt collectors and other segments of the consumer finance industry. It creates and enforces rules to protect consumers from unfair, deceptive, or abusive practices.

The CFPB is one of the latest U.S. government agencies to have its work halted by the Trump administration and Elon Musk’s Department of Government Efficiency.

At a forum earlier this week Massachusetts Attorney General Andrea Joy Campbell called the weakening of the bureau “a national emergency” and said that some states were “stepping away wholeheartedly” from work on protecting their own consumers.

“It’s not consistent – what we’re doing in Massachusetts – in every single state across the country,” she said. “So you will have elders and veterans and other consumers who are left out without anyone to fight for them on their behalf, with no resources and weapons to fight back.”

Illinois state Senator Mark Walker was already working on legislation to help consumers, but said that in the wake of Trump’s moves against the CFPB, that “the urgency is much higher now.

“They apparently closed the doors and put everyone on leave,” he told Stateline. “And I think it’s become critical now that we figure out exactly what we do to respond to these kinds of issues that consumers in Illinois have.”

The work of the CFPB has long-since been targeted by conservatives, who complain the independent agency, funded by the Federal Reserve System, lacks sufficient supervision and regularly exceeds its regulatory authority.

Last month, Russell Vought, the newly installed director of the Office of Management and Budget, told the CFPB to stop its investigations and work on proposed rules.

He instructed the agency to suspend the enforcement dates of any rules that had been finalized but not yet put into effect, and closed the CFPB's offices for a week.

Trump’s actions against the CFPB have already been challenged in court. Last month, 23 states and the District of Columbia asked a federal judge in the Baltimore case to issue an injunction blocking the administration from defunding the agency.

The states argued they will suffer permanent damage by losing the CFPB’s processing of consumer complaints, data collection and distribution of money to harmed consumers.

In addition, just prior to Trump’s return to office in January, the CFPB released guidance on how states could strengthen their own consumer protections. The guidance highlighted previous ways in which states had authority to enforce federal rules.

“Federal law should be a floor, not a ceiling, for the protection of consumers,” the report said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments